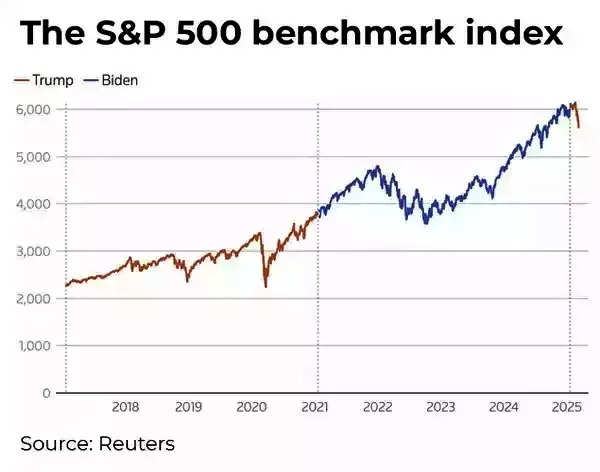

This is havoc in American stock markets! The S&P 500 has fallen by more than 10% since its highest level which was seen last month. The trade war of US President Donald Trump is causing unrest and economists are attentive on how much pain is there American economy must bear. Fear matures with an American economic recession and also talks about a landscape such as a stagflation, where the growth of GDP stabilizes and the tariff causes more inflation. In such a scenario, where is India standing? What would be the high American tariff for India and the US economic recession? We ask experts and are in touch with India’s GDP development, and American tariffs.

Trump’s self-declared trade war is seen by economists as a challenge to the American economy because it can result in high prices, slow growth and low jobs. This uncertainty around the future possibilities of the American economy comes after showing flexibility during the Kovid epidemic. Indeed, the US is looking at a phase of ‘Global outperforms’, with a Reuters report, with a steady decline above the GDP growth and inflation.

Trump told Fox News on Sunday, “It is a period of infection because what we are doing is very big – we are bringing money back to America.”

S&P500 benchmark index

Sachchidanand Shukla – The Group’s Chief Economist, L&T think that the time and indexing of Donald Trump’s tariff moves has surprised everyone, even though Trump and Tariff were considered ‘known -unnatural’.

“The most hopes were to target (Trump) to target China first, but he announced 25% tariffs on American colleagues like Mexico and Canada and only later implemented 10% tariffs on China. Also, with all the uncertainty and impact on the economy around the tariff, people postpone the consumption, investment and business decisions, which can affect the real economy,” he can influence the real economy.

what are the chances US recession,

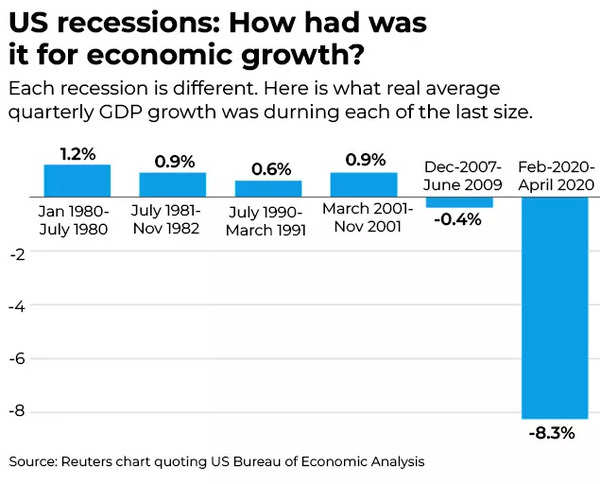

The recession occurs when the gross domestic product (GDP) of the economy comes down in a meaningful way. Typically, if the GDP of the economy contracts for two quarters in a row, it is seen as a recession. Historically, the recession is expensive, not the same with the pain of contraction.

American recession

According to a report by Reuters, an American recession may be caused by the instability in the spirit, the stock market accident, and the decline in activity for Trump’s tariff, which changes global trade.

KPMG chief economist Dianek told Reuters that an American recession could not be denied until the beginning of next year. “A price shock on his face, tariffs can also begin to kill demand,” he was quoted saying. Dianee Swonk said that if consumers are careful with expenses, the firms have to face the uncertainty of investing and hiring, it will have an impact.

DK Srivastava, Chief Policy Advisor, EY India looks at the possibility of the American economy into an important economic recession if the lump sum is not quite strong as a recession. “The main reason for this will be the required adverse effect on the total demand due to various cuts in government programs and currently applied in the US,” he said.

However, Srivastava says that the US economic downturn is likely to be for a limited period only. “As the cost cut measures are effective, especially the decline in energy prices at the US and globally, the US economy must start to improve gradually,” they say.

Madan Sabnavis, the chief economist of Bank of Baroda, says that America is unlikely to come into a recession. Tariffs introduced by the Trump administration are a tool to encourage local production. If it works, Sabnavis told TOI.

“If taken to the logical end, the result may be more inflation. This can affect demand on the border. However, this may not really be expected because the government will monitor the flow of goods and services, ”they say.

“If other countries tariff less, it can promote American exports on the other side. Therefore, Prima Facial, I don’t think the possibility of recession in the USA looks as now, although someone has to see how things work on the tariff’s front, ”he says.

Why is the Trump government not worried?

The Trump administration does not look worried about the possibility of American recession. While Trump himself has said that the American economy is in ‘infection’, his team has talked about ‘detox’. US Commerce Secretary Howard Lutnik has also said that an American recession would be ‘worth’ that Trump’s policies are in place.

Sachidanand Shukla noted that by recent statements by Trump and his advisors, it appears that they are ready to take short -term pain for the economy, even though it means that the US economy is moving into a recession with the ‘main road unlike Wall Street’ in the medium term.

“Trump has indicated himself on the ‘duration of infection’. It is believed that the idea of the team seems to be to increase the pain so that any pain can be convicted on the earlier administration and the economy is cured once, later during Trump’s tenure, they can take credit for it. Therefore, a recession or a wall street accident is not yet a big concern for them.

Does India need to worry?

Indian stock markets have seen a major improvement over the last few months – with the BSE Sensex it exceeds 14% to about 86,000. Various reasons have been cited for the stock market crash – GDP growth from the market, RBI’s tight liquidity, and global economic uncertainty are being overwated at a slow pace compared to post trump’s tariff move.

However, a recent report by Morgan Stanley suggests that the Indian stock markets look attractive for long -term. Morgan Stanley has also retained the Sensx target at the end of his year of 105,000. Ridam Desai, equity strategist at Morgan Stanley, said, “There is not a possible positive change in the basic things in the price – we hope that India will fix the lost ground against its colleague group through the rest of the 2025.”

The Indian economy is the fastest growing major economy in the world, and that title is expected to continue in the coming years as per IMF forecasts. The fifth largest economy in the world slowed down its GDP growth in the second quarter of FY 2015. However, economists point to a quick recovery with recently released GDP data, showing an increase of 6.2% in Q3 FY25.

Madan Sabnavis says there are two concerns about India; “First, if we reduce tariffs on American imports, the domestic industry can be affected. Second, due to high tariffs on Indian goods, the US may be a source from other markets thus affects our exports. The latter is currently a concern because America is our major export destination, ”he says.

The main economist of the group of L&T believes that India will probably maintain its tag of the fastest growing major economy. “From the point of view of India, our relations for America are very few on business. We do not export or import high number as some other big exporters in the US, ”Shukla explains.

“But, what the US economic downturn will do, it will affect the autocratic flow of the dollar for India – both in the case of portfolio flow and FDI. The currency will also take a hit, which in turn will hit the Indian economy, ”he warns.

DK Srivastava of EY points to the fact that the Indian economy is already facing important uncertainties due to the disruption of the global recession and supply chain. “This adverse global impact is likely to be more pronounced with American tariff modifications and the impact on exports from India to the US, especially related to export of goods,” they say.

However, he believes that policy makers in India should be able to neutralize this effect by stimulating domestic demand to a large extent. “In fact they should continue to rely on the expansion of the government infrastructure that have relatively large multiplies. India should also benefit from expected low global energy prices, ”they say.

Sachidanand Shukla explains that in the world struggling for development, India stands outside. “China is watching deflation, Europe has its own issues – a 6-6.5% increase for India is gaining. India has made necessary changes in the fiscal policy through crossing its level of spending, which is on track with capital expenditure. On the monetary side, the RBI has begun to cut rates and affect liquidity and that cycle is likely to continue. Both fiscal and monetary policies are now working to keep the Indian economy on track, so I believe that we are relatively better than other major economies to deal with American economic disruptions, ”they have concluded.

I am a passionate digital marketer, content writer, and blogger. With years of experience in crafting compelling content and driving digital strategies. I’m always exploring new trends, optimizing strategies, and creating content that resonates with audiences. When I’m not working, you’ll find me diving into the latest digital marketing insights or experimenting with new blogging ideas.